The last year has been a hot one for commodities of all stripes, with most seeing spectacular gains and losses. Oil grabbed headlines as it went to negative dollars a barrel, and gold was also in the spotlight, except it went in the opposite direction to hit all-time highs. Even commodities that are relatively mundane to most of us—like soybeans—saw sharp swings in valuation as disruptions to every facet of our lives and economies melded with a pandemic mindset.

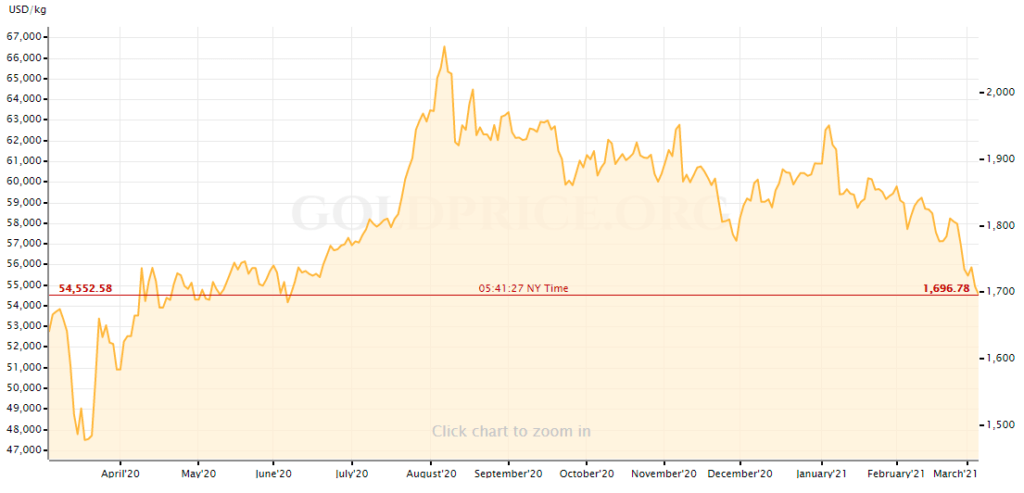

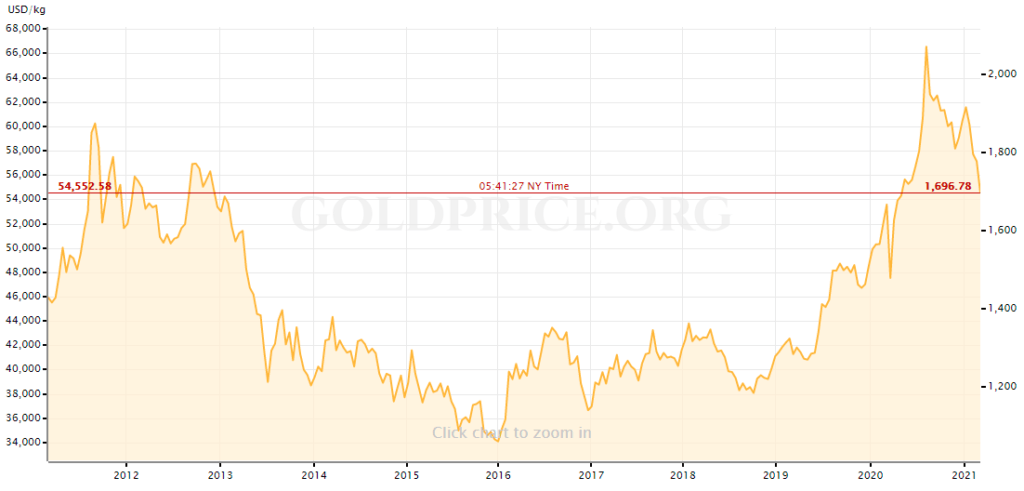

Of course, with all the initial fervor and panic subsiding somewhat, things have begun to correct or slow down. Oil prices have recovered completely, and soybeans have topped out. And now, the inevitable has happened—Gold’s taken a fall below US$1700/ounce and looking like it’s heading back towards pre-pandemic price levels.

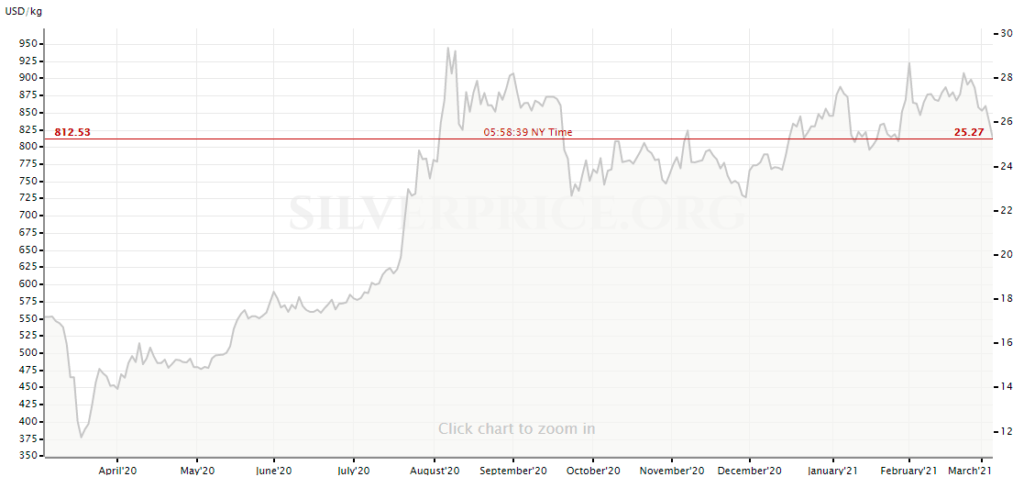

Silver’s also taken an intra-day fall, but the current gold to silver ratio reveals silver stability to be expected

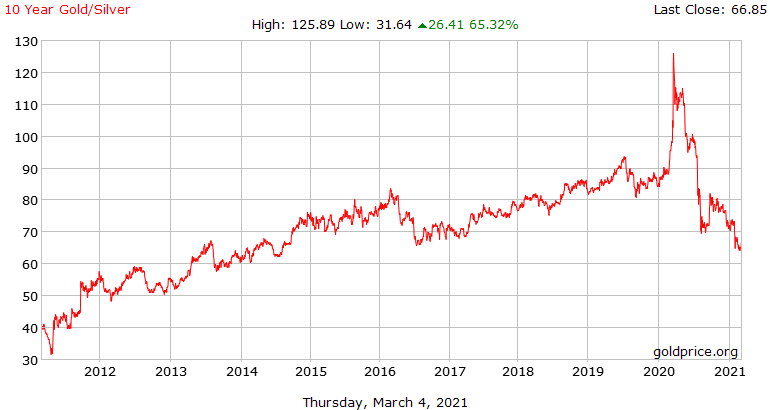

Gold and silver prices do find themselves linked, and similar trends do emerge at various times and periods. However, to say that they’re inextricably linked is a gross misstatement. For example, in just the last decade, the gold to silver ratio (the number of ounces of silver required to purchase one ounce of gold) has swung through a range of almost 100. In 2011, you only needed a little over 30 ounces of silver to buy an ounce of gold. At the peak of COVID gold-hype, that shot up to just over 125 ounces of silver per ounce of gold.

What this means for silver prices in the face of falling gold prices is that a correction in the gold/silver ratio is likely to see silver holding relatively steady for now. The gold/silver ratio’s clear downwards trend indicates silver can sustain a reasonably sharp decline in gold prices before getting pulled back down along with gold.

A wider view of silver prices even reveals a slight upwards trend

Looking beyond the intraday movements making headlines, we see a different story in the overall trends in gold and silver prices. While gold is now, arguably, in a sideways market at best, silver hasn’t backed off far from its COVID-19 peak. In fact, since its double-dip correction in the backend of last year, it now looks to be establishing a slight upwards trend.

However, looking beyond the events that have unfolded over the course of the past year, a more interesting divergence in gold and silver prices is revealed. At the moment, gold is still hovering at previous highs seen in the early years of the last decade. On the other hand, Silver never even peaked near its highs of the same early 2010s period.

When considering this with the gold/silver ratio in mind, it seems natural that we have every reason to believe silver’s still got a lot of strength left in its current pricing. The fact that silver didn’t shoot as high as gold—as revealed in the price performance over the last decade and the gold/silver ratio—indicates it has none of the gold hype built into its current pricing and should remain a solid value storing asset.

There’s still strength in gold, however, and a bullion alternative might be the way into it

There’s little doubt that, even as gold tumbles from its temporary perch, precious metals have historically proven to be excellent storers of value. And there’s ample evidence that investors will continue to see precious metals this way. Even with gold prices taking a tumble as speculator liquidity exits the market, demand for gold and silver bullion has only continued to increase. In fact, demand for bullion has soared so high this year that the U.S. mint has been rationing its supply of bullion and limiting what it makes available to investors, suggesting that the current decline in gold is just a short-term correction for a little pandemic-driven over-exuberance.

So with silver looking strong and gold likely to be undergoing nothing but a short-term correction, are there any alternatives to obtaining physical bullion? As it turns out, there is one, and it comes in the form of two bullion-backed currencies by LODE: the AGX (silver) and AUX (gold) coins. These coins, built on secure blockchain technology and backed one-to-one by vaulted and insured gold and silver, offer a real alternative to investors looking to get their hands on gold and silver bullion. Readily exchangeable at any moment for their equivalent in physical metal, they offer a level of security that fiat and cryptocurrencies lack.

But LODE didn’t stop at simply making what would otherwise be a precious metal vaulting service. Instead, LODE wants to bring gold- and silver-backed currency as a viable alternative to the inflation-prone fiat currencies we’re currently stuck with. The result of this drive is the LODEpay app, which brings PayPal/Square/Stripe/etc. like functionality to precious metals—now you can buy a coffee and do a spot of online shopping using silver and gold as the means of exchange. In other words, AGX and AUX coins offer the perfect combination of precious metal stability and regular currency liquidity.

__

(Featured image by 12222786 via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of CAStocks, its management, staff or associates. Please see our disclaimer for more information.

This article may contain forward-looking statements. Forward-looking statements are generally identified by the words “believe”, “plan”, “estimate”, “estimate”, “become”, “plan”, “will” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, actual results that the Company may achieve may differ materially from the forward-looking statements, which reflect the views of the Company’s management only as of the date hereof. In addition, please ensure that you read this important information.