AUG. 19 2020, MICHAEL JERMAINE CARDS, CASTOCKS — Tencent, Activision: big name gaming stocks overvalued, ready for big correction—smaller players Leaf Mobile undervalued, set to grow

A couple of weeks ago, I concluded that the price of some overlooked gaming stocks like Leaf Mobile (TSX.V: LEAF) were lagging behind their true value with respect to market fundamentals and their own promising results. I stated that they were ready for a big upwards correction.

Yesterday, Leaf Mobile closed at C$0.28, almost 17% up from the C$0.24 it closed at on Aug. 19.

The big end of town over-hyped, due for a correction

I also argued that the hype driving gaming stock prices was leading to overvaluations which were due for a correction. Admittedly, I wasn’t perfect with the timing.

The big gaming stocks have been flailing around at their over the top prices—most largely range-bound—since then. A few have even experienced modest gains since then as the more optimistic investors bought into the previous few months of hype and price momentum.

But let’s be fair. Timing the market is hard, particularly when the biggest drivers of price are hype and fear-driven sentiment rather than the usual cycles of news releases, fundamental market data and technical analysis.

But finally, clear signs that the overinflated prices are ready to correct are emerging.

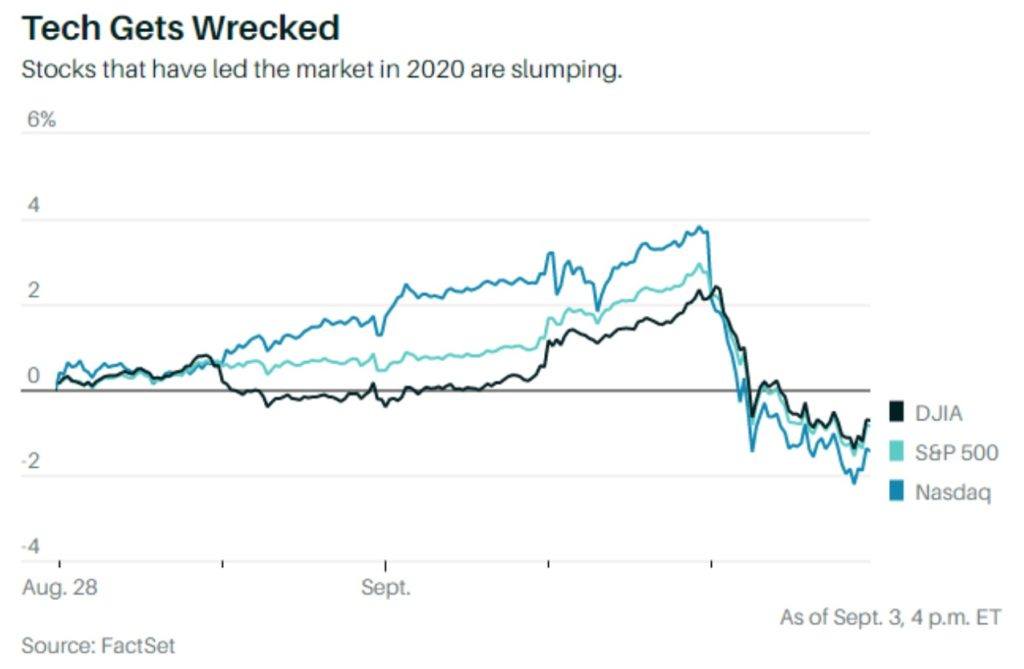

SEPT. 3, 2020, NICHOLAS JASINSKI, BARRON’S — The Tech Stock Selloff Accelerated Today. It Was Time for a Pullback.

A big reversal in tech stock momentum is now taking place.

Big-name gaming stocks are following the big-tech selloff

Gaming stocks have been caught up in the massive selloff of tech stocks as well. Take a look at the Activision Blizzard (NASDAQ: ATVI) chart for the period Aug. 19 through to yesterday, Sept. 3.

As I said back in August, a lot of gaming stocks have been riding on a wave of overestimated sector growth. Yes, gaming has boomed throughout the pandemic and a price increase over pre-pandemic prices is certainly warranted. But not to the extreme extent that we’ve seen.

At market’s close yesterday, Activision Blizzard was trading at US$80.31. In the months leading into COVID-19 outbreak, it was trading along the $60 a share mark, with a couple of short excursions to a few dollars either side of this mark. That means, even after this week’s big selloff, it’s still sitting well over 30% above the market’s pre-COVID valuation.

That’s still too high.

COVID-19 to have a long-term impact on gaming growth, but more subdued than immediate impulse

The hype over gaming hasn’t been entirely unfounded. As the world has been thrust into lockdowns and we’ve become more reliant on tech tools to get work done and to amuse us, it’s only a natural consequence that companies catering to these needs have profited.

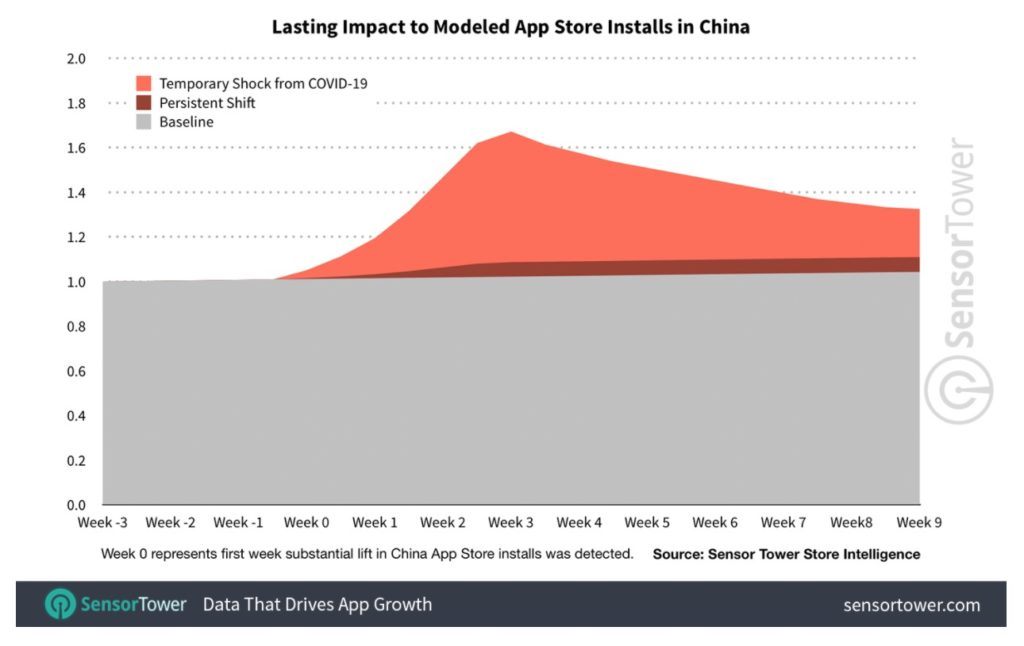

The problem with the hype, however, is that it has mirrored the short-term impulse effect of the crisis, which is a massive bump over any long-term effect that can be expected.

Modelling on the lasting impact of mobile app store installs done by Sensor Data perfectly illustrates this point, showing the persistent shift to the baseline that will result from the temporary COVID-19 shock.

The reason mobile gaming is so interesting to look at is because it is the gaming segment that has experienced the most explosive growth. Already taking off before the pandemic, it was the perfect outlet for confined populations owing to its low barrier to entry.

It’s not too late to profit from gaming stocks—Leaf Mobile is still undervalued

Leaf Mobile is still undervalued, despite its recent gains. While gains of over 16% in a couple of weeks are certainly dramatic, they still don’t represent enough of a correction from the stock’s undervalued price from then.

Right before the gaming stock hype started pumping up the market, Leaf was sitting at a modest C$0.25 per share: today’s price only represents a bump inline with the increased long-term mobile gaming growth expectations post COVID.

But Leaf has delivered a lot since then.

Leaf Mobile Delivers Record Q2 results on the back of latest game release

Leaf Mobile has played the celebrity IP card. And well. Their latest cannabis game release, playing on the back of the celebrity power of Cheech and Chong is driving massive results for the company.

Highlights from Leaf Mobile’s financial results:

- Total Revenue was $9.6M in Q2 2020, increasing by $4.4M (+84%) compared to the previous quarter of $5.2M.

- First-Half 2020 (1H 2020) Revenues exceeded $14.7M, surpassing Full Year 2019 revenue results of $8.4M a 74% increase, adding +$6.3M to the topline.

- Cash Flow from game operations is $2.2M for 1H 2020, increasing $3.7M vs same period 2019 as a result of significant growth across our game portfolio and introduction of new title, Cheech & Chong Bud Farm in Q2.

Clearly, their winning formula for their counter cultural games is working and these enormous figures are simply not being reflected in Leaf’s share prices yet.

Their upcoming release, a collaboration with Cyprus Hill rapper B-Real, promises to be even bigger. As they refine their revenue models and learn lessons on how to best maximize their investments in celebrity IP, this will only lead to even bigger results for this promising young company.

—

(Featured image by SCREEN POST via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of CAStocks, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.