The Canadian aerospace industry continues to flourish with the added boost from the government’s 2017 “Super Cluster” initiatives. The initiative funnels money and resources to a set of companies supporting its policies of accelerated economic growth in a decidedly innovative way. The ultimate intent becomes positioning Canadian firms for global leadership in industries.

As part of the MOST21 (Mobility System and Technologies for the 21st century) portion of the Super Cluster initiative, the aerospace industry gains access to the latest innovations. Not only does the aerospace industry think tank Aero Montreal participate, but also some of the same participants belong to the think tank of Most21.

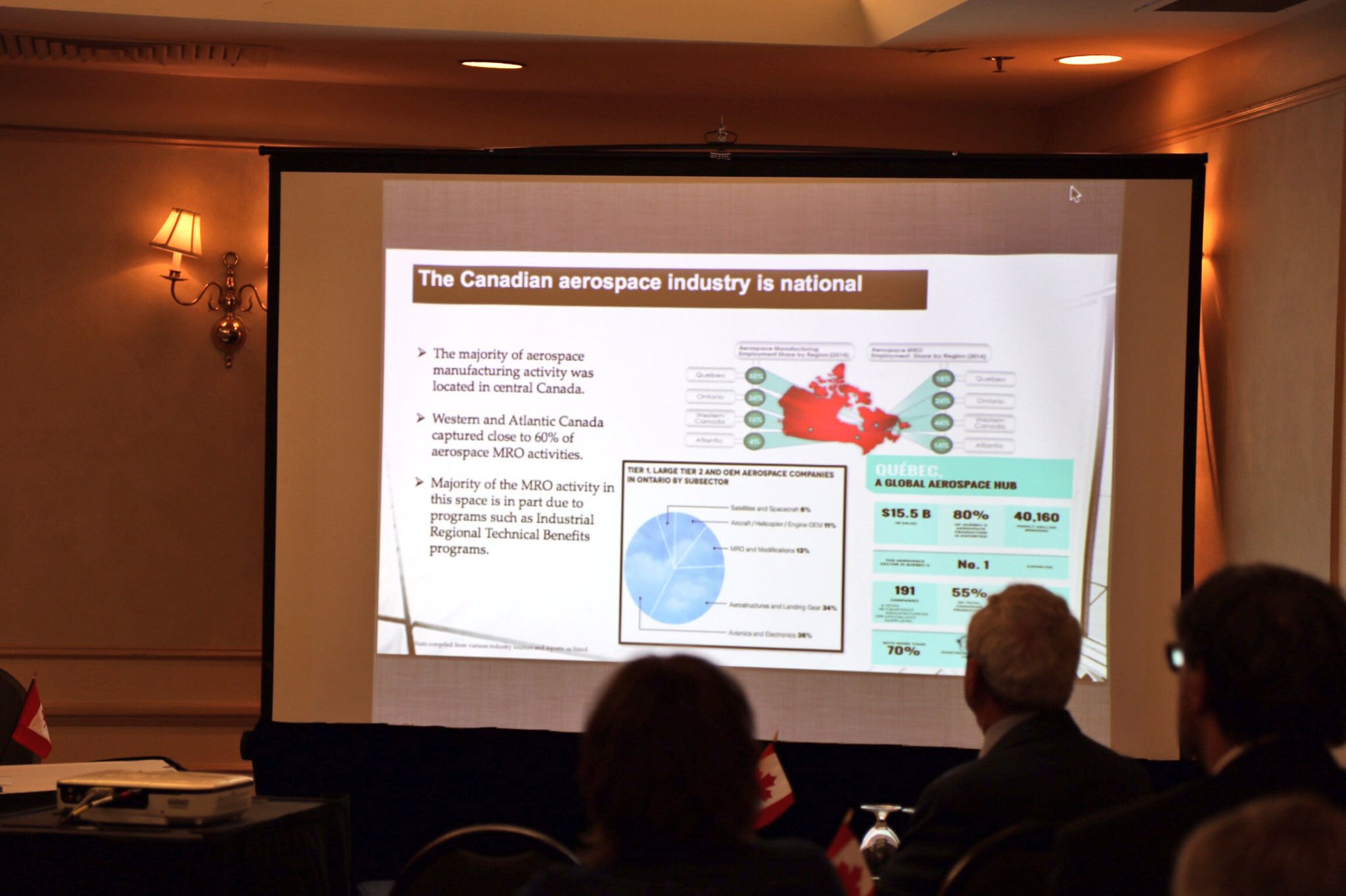

Canadian aerospace industry background

At the moment, Canada’s space sector has at least 200 private companies participating. About 6,700 highly skilled employees fill the ranks to perform the tasks assigned. With $2.8 billion in revenues annually its strategy of using international collaborations to support the aerospace industry has begun to pay well. And with The Canadian Space Agency having dynamic relationships with NASA and the European Space Agency, it’s no surprise that it has a global reputation for excellent quality in robotics, exploration and satellite communications.

In a 2018 State of Canada’s Aerospace Industry report, the government highlighted aerospace industry sales. As per the report,commercial aerospace came in at 86 percent of the ecosystem, with most of the positive 5-year growth of the gross domestic product as in +6 percent from 2012 to 2017 coming from commercial aerospace. The report also highlighted part of the policy encourages free and open trade creating possibilities for associated industries products for aviation and aerospace to make mutually beneficial partnerships. What’s even more impressive however, is how a June 2018 Global Newswire release reveal that Canada’s aerospace exports have grown 50 percent in the last 15 years.

A set of analysts have commented on Canadian aerospace companies as good buys for the long term investor, and here are some of them:

Magellan Aerospace Corporation in Q2 of 2018 reported it earned $23.46-million. It showed a little over 4 percent decrease from the same period in 2017 making it a good opportunity to purchase. Recently the company contracted with Hamilton Sundstrand Corporation who supports and manufactures aerospace products. The Canadian government plans on increasing defense spending. Motley Fool tied Magellan to the McCain National Defense Authorization Act for Fiscal 2019 as a possible player in USA markets.

Bombardier, Inc. manufactures trains and planes. Because of its diversification, it becomes hard to predict the overall line of up or down in this stock. It may be better to check each division rather than the overall numbers. The company delivers its sometimes large business jet orders on time, but orders for such products did not increase much from 2017. In mid categories it continues to outperform its competitors. Its train endeavors keep the company stable, allowing it to do some things other companies would not attempt. Bumping up against Boeing when it comes to airplane parts suppliers Bombardier gets ravaged. Getting supply lines not so affected by Boeing as in buying airplane supplier part companies may become a solution. The CSeries product line drained their resources for a time, but that has been solved. Forming a new nexus of suppliers could prove profitable and a set of investors to help navigate that may give Boeing a disruption for once.

CAE Inc. straddles Canada and U.S. markets. In September 2018, it received an eight-year $200 million U.S. Air Force contract for the C-130 Aircrew Training System. Before that, the company announced a $1 billion investment over a five-year period to stay at the forefront of the training industry. It will fund Project Digital Intelligence.

Associated industries

As exciting as the possible investors became for direct investment in Canada’s aerospace industry an array of associated companies may offer a better opportunity for profit. It takes some time with research to discover the relationships to Canadian companies, but USA support, suppliers and innovators have built relationships with Canada.

Canada has also fully supported biofuels and their aviation/aerospace industry seconds that support of such endeavors. The USDA did a 2017 report on the possibilities of it all. Canada’s production has reached capacity in biofuels, but its need exceeds its production especially with the carbon intensity benchmarks coming.

For example, the California firm Greenbelt Resources Corporation has award-winning waste to energy solutions, taking local USA waste and converting it to biofuel. The firm came up with a modular design of a proprietary process control system and a patent-pending membrane dehydration system that makes for good energy savings. This makes the company a potential leader in the field in the USA. At the same time, Greenbelt Resources Corporation made a deal late last 2017 with Texas company Puration, Inc. to develop a cannabis extraction plant in California jointly. In June 2018, Puration acquired First Choice Nursery in Canada, whereas upon completion of that deal will have access to the markets in Canada. It could give Greenbelt Resources access to the Canadian biofuel markets. As stated earlier, doing the research on these companies will often lead to better investment options.

(Featured image by Dennis Jarvis via Flickr. CC BY-SA 2.0.)