Last year was a tough one for Zinc miners like Ivanhoe Mines [TSX:IVN](OTCQX:IVPAF), Trevali Mining [TSX:TV](OTCQX:TREVF), and Slave Lake Zinc Corp (CSE:SLZ). Covid-19 plunged zinc deep into oversupply territory as global manufacturing ground to a halt. Rising zinc warehouse stock levels tanked zinc spot prices to 4-year lows.

But demand is rebounding fast.

S&P Global Platt is reporting zinc demand growth will outpace supply growth this year, and prices are already hitting multi-year highs of around US$3000 per ton. Further, peak global zinc production is expected to occur sometime around 2024, hitting just over the 14 million mt/year mark. This is not much more than current production levels, which hover around the 13.5 million mt/year range.

Good news for zinc investors and zinc miners

With current demand now at approximately 13.5 million mt/year, hitting an annual global production of 14 million mt would, once again, push zinc supply well into surplus. But zinc demand will not remain stable over the coming years—it is only going to balloon.

The major driving force behind this will be the increasing importance of zinc as a key battery metal as the pace of the green energy transition picks up. This will be driven primarily by grid-scale, long-term energy storage projects, where zinc offers multiple benefits that are attracting a lot of attention.

Growing demand for galvanized steel products will also further compound demand-side pressure on zinc. Currently, 60% of global zinc supplies are consumed for galvanizing purposes. With the automotive and construction industries ramping up demand for flat-rolled galvanized products, zinc supplies will be further strained.

Why zinc will become a key battery metal

Cost benefits are just one of the many advantages of zinc when compared to other battery metals. Take lithium for comparison. Already having hit peaks of over US$25k/mt and with high battery production overheads, lithium’s use cases as a battery metal are limited. Besides use cases where space efficiency and fast charging capability are worth the significant additional costs (portable electronic goods and EVs), zinc battery technology is set to reign supreme.

But zinc’s benefits go much further than this, which is strengthening interest.

Take geopolitical security for one. Unlike battery metals like lithium, North America has significant zinc reserves in its own backyard. Then there are also the safety benefits so critical to infrastructure projects. Zinc batteries are significantly more fire-resistant compared to other battery technologies, and it’s a much safer material to handle to boot.

Zinc price expectations

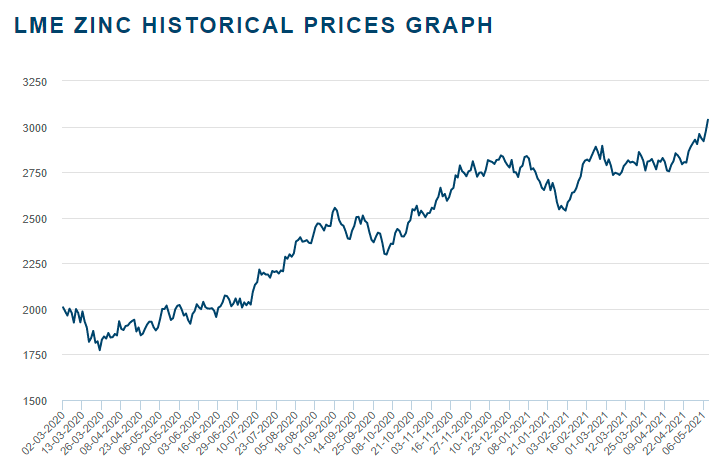

After hitting a low of US$1815 per ton in late March last year, zinc prices have rebounded strongly, with the exception of a few minor corrections along the way. Now, a well-established, long-term upwards trend has formed, with plenty of headroom left before reaching the next point of major resistance at around the US$3200 per ton mark.

In addition, good support sits below current prices, with a long-term worst-case scenario looking to be well supported at about US$2500 per ton.

In the longer term, the sky’s the limit. Zinc prices above US$4000 aren’t unprecedented, and can even be expected when battery use takes off. With a historical high of close to US$4500, growing demand for the mineral, and support for prices above the US$3500 per ton mark already well established, there’s good reason for long-term prices to easily exceed US$4000 and never look back.

Where investors should be looking to capitalize on zinc demand

For investors, there are a number of options to look at here. Stationary energy storage tech is one area for exploration, and many companies invested in zinc battery technology will be found at a significant discount when potential future revenues are accounted for. However, many of these will be highly speculative plays. While zinc battery technology is now a sound bet, the big unknown here is which players will consistently win contracts as grids transition to renewables.

The safer, but no less profitable bet here is in zinc mining. With price security guaranteed by diminishing zinc production growth and increasing demand for the mineral, zinc mining is set to become a highly lucrative addition to investors’ portfolios.

Key companies to look out for here include Slave Lake Zinc Corp (CSE:SLZ), Teck Resources (NYSE: TECK), Glencore plc (OTC: GLNCY), Trevali Mining [TSX:TV] (OTCQX:TREVF), Ivanhoe Mines [TSX:IVN](OTCQX:IVPAF), and Hudbay Minerals [TSX:HBM] (NYSE:HBM). All have zinc mining operations, and most have seen some solid share price appreciation in recent times.

Why investors should be looking towards Slave Lake Zinc (CSE:SLZ)

Pursuing a zinc mining investment thesis can be difficult. While all the above-mentioned companies have zinc mining operations, many are diversified across a broad spectrum of mineral resources, with some only involved in zinc as a consequence of extracting other mineral targets.

For investors looking to capitalize on growing zinc demand without diluting gains across overly diversified operators, this shoots Slave Lake Zinc Corp. into the number one position.

Heavily focused on developing its core zinc property at O’Connor Lake in the South Slave Region of the Northwest Territories, Slave Lake Zinc offers investors access to one of the most promising North American zinc properties. And, with target zinc deposits established by earlier explorations still open along strike and at depth, Slave Lake Zinc Corp. has a lot of unrealized value tucked away.

Historically, the property has produced valuable zinc deposits, with a proven 13.5% zinc concentration found in earlier bulk samples exceeding 25 tons.

The timing may also be perfect. Recently completing an extensive aerial survey of the property’s structural corridor, better than expected results from the collected data will see its already rising share price jump significantly. And with a YTD share price performance of close to 600%, expect any additional discoveries to generate significant interest in this zinc miner.

—

(Featured image by Hannu Iso-Oja via Pexels)

WARNING: This article was written by a third party contributor and does not reflect the opinion of CAStocks, its management, staff or associates. Please see our disclaimer for more information.

This article may contain forward-looking statements. Forward-looking statements are generally identified by the words “believe”, “plan”, “estimate”, “estimate”, “become”, “plan”, “will” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, actual results that the Company may achieve may differ materially from the forward-looking statements, which reflect the views of the Company’s management only as of the date hereof. In addition, please ensure that you read this important information.