The 2020 TSX30™ has just been released, and Canada’s tech sector is showing its strength. Success story Shopify Inc. (TSX: SHOP) has absolutely dominated the rankings, shooting into the top spot with an incredible 3-year dividend-adjusted share price growth of 1043%.

This is the second year in a row that Shopify made the cut, after slipping into the inaugural TSX30 last year with a still massive 833% growth in share price. This high-flying company is now the biggest stock on the TSX, not only by growth, but also by market cap. With a current valuation of just over $112 billion at the time of writing, it beats out runner up, Royal Bank of Canada (TSX: RY), by $6 billion.

Entire tech sector is showing impressive growth

The superstar of the moment, Shopify, isn’t the only tech stock showing the growing strength of our home-grown tech companies. With the sector gaining an impressive five spots on the annual ranking of top-performing stocks, and the likes of 2019 luminaries Constellation Software Inc. (TSX: CSU) making a repeat appearance on this year’s listing, the entire sector is showing a lot of promise.

In particular, the enterprise software space has been posting some impressive growth in recent years. New entrants, Enghouse Systems Ltd. (TSX: ENGH) and Kinaxis Inc. (TSX: KSX), who’ve posted a respective 185% and 140% growth, are both industry solution providers in the enterprise market.

Surprise! An airline made it to this year’s list

It’s been all doom and gloom for airlines lately, with the last few years of gains being largely wiped out by the ongoing COVID-19 pandemic. Last year’s star airline, Air Canada (TSX: AC) had seen its shares plummet to less than half price compared to this time last year, when it made it to number seven on the list with a 3-year growth of 346%. Its current 3-year share price growth is now hovering around… 0%.

But despite the terrible conditions most airlines have been facing, there is one who’s not only survived but thrived: Cargojet Inc. (TSX: CJT), who posted a 166% growth in share price back in 2019, slotting into 20th position on the year’s list. This year, Cargojet has demonstrated that companies in the right place at the right time can make the most out of a bad situation, jumping up ten places after seeing its 3-year performance skyrocket even further this year, shooting up to 248%. This is owing to the big uptick in demand placed on logistics providers as the world has shifted towards online shopping after lockdowns forced us to stay home.

Who else has made it two years in a row?

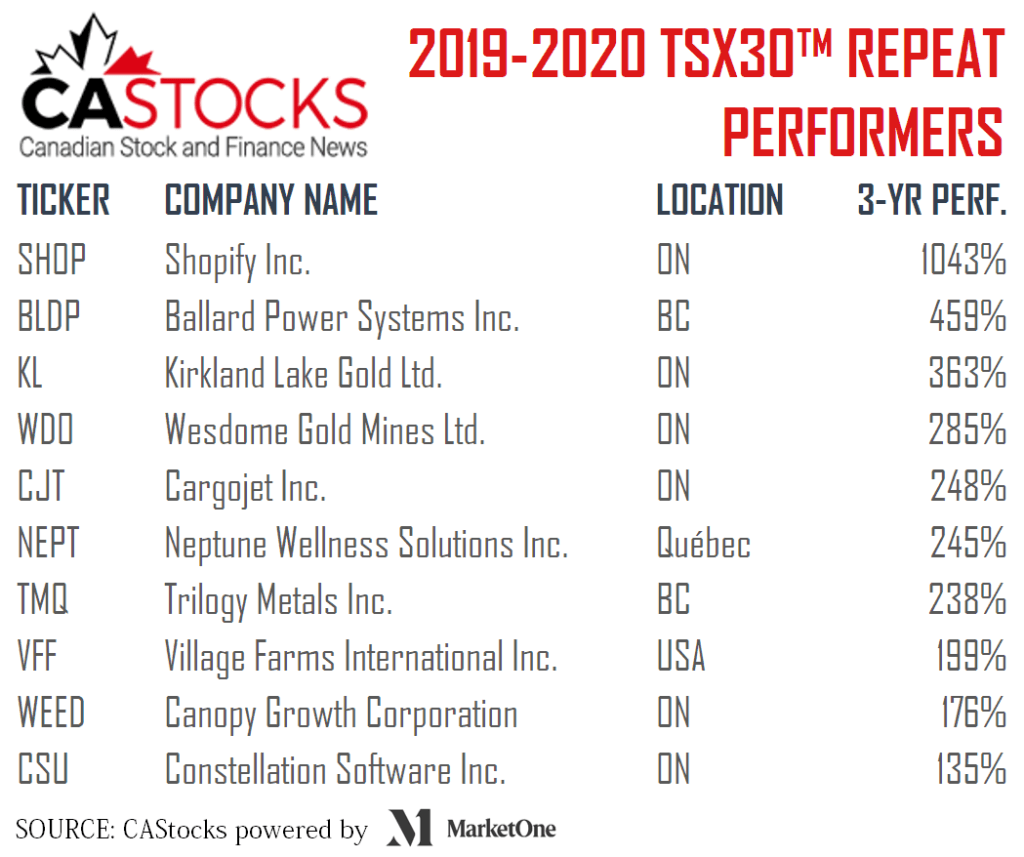

Of the thirty companies on the list, only ten have managed to make it two years in a row.

Again, being in the right place at the right time is playing a significant role here, with the repeat performers list being made up of companies in industries that have been making headlines over the last couple years. Tech, renewable energy, cannabis, health and wellness, and, of course, gold, which, at this time last year, had just broken above the US$1400/ounce mark for the first time in over five years. And it’s performance this year has been nothing short of record-breaking.

What is the TSX30™

The TSX30™ is a relatively new initiative. Founded last year, in 2019, the TSX30™ ranks the top performing stocks, based on their three-year, dividend-adjusted share price performance. To qualify for consideration, companies must have a market cap of at least $50 million, and a minimum dividend-adjusted share price of $0.50 at the close of the consideration period. In 2019, there were a little over 600 stocks which were eligible for consideration.

—

(Featured image by Gerd Altmann via Pixabay)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of CAStocks, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof.