Following the outbreak of the COVID-19 pandemic the global gaming industry has been a phenomenal success. As lockdown and social distancing measures kicked in around the world, people suddenly found themselves with more time on their hands. Already established gamers increased their consumption and, perhaps needing a little more stimulation than the average Netflix binge provides, many new users found a passion for gaming.

Amongst the biggest success stories to rise up out of the global pandemic, we find global powerhouses such as Tencent Holdings (OTC: TCEHY), Activision Blizzard (NASDAQ: ATVI) and Canadian counter cultural game company Leaf Mobile (TSXV: LEAF). Each of these firms experienced explosive growth as investors jumped on the hype surrounding gaming stocks. Popular gaming ETFs have also followed this trend, with popular funds like Global X Video Games & Esports ETF (HERO) and VanEck Vectors Video Gaming and eSports ETF (ESPO) hitting prices almost double the price of their pre-covid price explosion levels.

While investment in gaming stocks immediately following the inflection point of global market reactions to the outbreak was a wise move, the hype which followed has seen massive overvaluations in the sector. Whilst it is true that an influx of new gamers will certainly help bolster the industry in the long term, eventually the gaming sector will return to more reasonable levels if lockdowns and social distancing measures ease.

Just how explosive was the growth in gaming stocks?

Following general market trends, gaming stocks also took a dip at the onset of the health crisis but quickly recovered. Hitting prices far exceeding anything seen pre-covid, gaming stocks hit prices unimaginable only months earlier. At the top of the frenzy, Tencent recovered to +79% over pre-covid lows, Activision Blizzard +120%, and Leaf Mobile hit a phenomenal high of +153% above lows seen in the month of April.

Similar explosive growth has also been seen in large gaming ETFs, with popular funds Global X Video Games & Esports ETF and VanEck Vectors Video Gaming and eSports ETF currently hitting prices at up to 50% above their respective $17.50 and $40 support levels established in the first quarter of this year.

Are these stocks now overvalued?

With the exception of Leaf Mobile, whose stock price has since made a correction, all of the mentioned stocks and funds are still finding support for prices that would never have been considered reasonable earlier in the year when the impending outbreak of COVID-19 was still being played down by global leaders.

This makes sense when a narrow view of the market is held. As other industries have fallen victim to the health crisis and gaming has grown, large amounts of capital have divested from weaker stocks and have sought shelter in COVID-proof stocks. The problem with this, however, is that the current inflated prices that have resulted from this potent mix of capital flows and industry hype do not reflect fundamental data underlying the gaming industry.

The data on COVID-19 impact

Recent data and analysis has painted a more sober story for the gaming sector than the current overhyped market prices would suggest. Whilst the forecasted figures for the gaming industry are certainly impressive—and they do indeed show that COVID-19 will have a long lasting positive impact on the industry—they pale in comparison to the inflated values that many gaming stocks and funds are still holding on to.

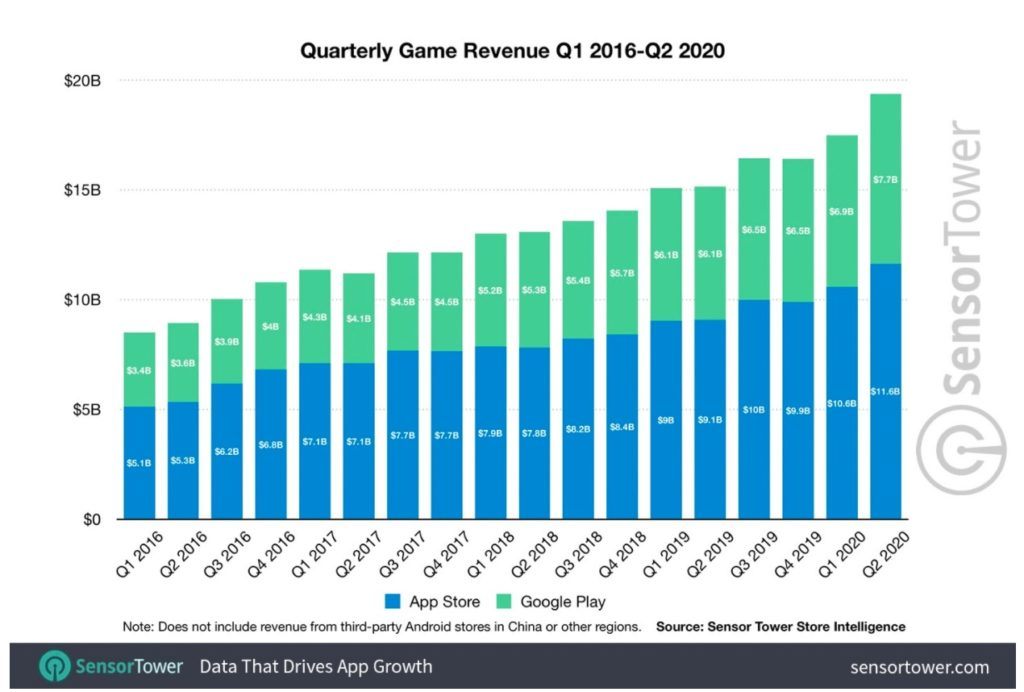

Looking at data gathered by Sensor Tower on quarterly app store revenues, a clear spike can be seen in Q2 2020, lining up with the explosion in gaming stock prices. The spike, however, is not as pronounced as what is being reflected in stock prices, only showing a 10.7% increase from Q1 2020 and 27% over the same period in 2019.

While double digit growth is certainly impressive, this has to be read with an understanding that revenues in both app stores have been—and were expected to to continue, crisis or not—growing consistently.

If looking at the difference between Q1 of 2020 and 2019, the year on year growth was around 16%. Applying this sort of growth to the Q2 figures from 2019, we end up with a real Q2 growth in app store revenues of less than 10% above built in industry expectations.

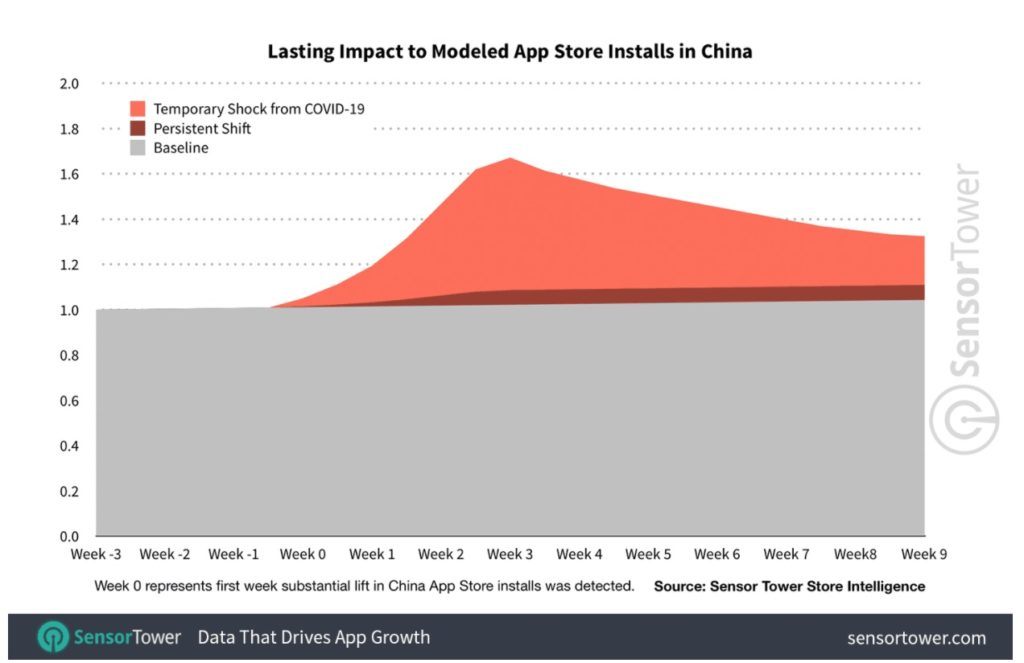

What is more troubling for holders of gaming assets that are still sitting at inflated prices is analysis performed on the impact of COVID-19 on Chinese market app installs.

The temporary shock which caused a massive uptick in installs at the onset of the crisis is pronounced, and mirrors the levels and rates of growth that rippled through to stock markets. But as with any impulse response, eventually things trend back to baseline levels with some residual effect.

Fortunately for makers of mobile apps, the forecast residual effect of the COVID-19 impulse is above previously forecast baseline levels. Unfortunately for holders of currently overvalued gaming assets, the approximately 10% increase over the previous baseline and previously priced-in revenue forecasts may not be enough to support the currently inflated gaming stock prices.

Leaf Mobile is one gaming stock worth reconsideration

Leaf Mobile (TSXV: LEAF), who are currently dominating the app stores in the growing market of counter cultural cannabis games—an over performing niche within the broader gaming market—have had their stock prices return to the $0.24-25 support levels established in April. This was prior to the frenzied spike in gaming stocks that took off in May when investors were still wary in general, regardless of industry.

This correction seems a little too strong, however, and there is a very good reason to believe that Leaf Mobile is currently priced well under value. This correction seems to be too strong given the recent releases of market data and analysis illustrating the lasting positive impact of COVID-19 on the gaming sector: clear growth is being shown above pre-crisis levels and expectations. While this growth doesn’t support the overinflated values some assets are still fetching, it is still a large increase over what investors had built into market prices back in April.

In addition to strong fundamental industry data which is yet to be reflected in Leaf Mobiles’s prices, they have also delivered well above expectations with their latest Cheech & Chong release. With an even bigger collaboration with B-Real recently announced and robust revenues being generated on the back of the organic installs and active users of their older releases, they’re in a very strong position.

__

(Featured image by Garrett Morrow via Pexels)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of CAStocks, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.