After closing last week at 16198.97 points, the S&P/TSX Composite Index got off to a rocky start this week, opening the week’s trading down 217.66 points at 15981.31. The sharp drop followed the market’s reaction to mounting fears that a second wave of COVID-19 will bring with it a new round of lockdown measures.

The S&P/TSX Venture Composite Index also opened the week lower, losing 14.82 points on last week’s 745.37 points close to open at 730.55.

The week has also seen TSX30 luminary, Sprott Inc. (TSX: SII), joining a small handful of predominantly precious metal mining stocks which gained inclusion on Monday.

More woes for Canadian oil

Further compounding the market’s losses at the week’s opening, Libyan onshore oil fields have been slowly ramping up production again, with fresh reports that exports of crude cargo from the Marsa el-Hariga port are predicted to recommence by the end of September. This will mark the first exports to leave the terminal in eight months.

The news hit the energy sector which, after the financial sector, represents one of the heaviest weightings in the index, accounting for approximately 13%. Amongst the largest of the energy stocks included on the index, oil and gas transporter Enbridge Inc. (TSX: ENB) lost close to 3% on the previous week’s close within minutes of trade opening this week.

Sprott Inc. gains inclusion in the index

Last week, Sprott (TSX: SII) was announced as one of the thirty stocks on the TSX, winning it inclusion in the TSX30 grouping. The grouping ranks the top 30 performing stocks—who meet minimum share price and market cap elegibility requirements—on the TSX according to their three-year, dividend-adjusted share price appreciation. After gaining +143% over the eligibility period, Sprott came in 24th place.

With two big inclusions in two weeks, Peter Grosskopf, Sprott’s CEO said, “we are honored to be added to the S&P/TSX composite index and ranked in the TSX30 program.” On the double achievement, he said “Both of these milestones are recognition of Sprott’s achievements over the past three years and I would like to thank our employees and board of directors for their contributions to the Company’s success. The fundamentals are in place for a long bull market in the precious metals area and we look forward to continuing to deliver outstanding results to our clients and shareholders.”

Precious metals gaining weight

This week saw a reshuffle of the S&P/TSX Composite Index, with precious metal mining stocks making up the bulk of new inclusions. Of the five new entries, Fortuna Silver Mines Inc. (TSX: FVI), New Gold Inc (TSX: NGD) and Osisko Mining Inc. (TSX: OSK)—all gold/silver focused—take three of the spots.

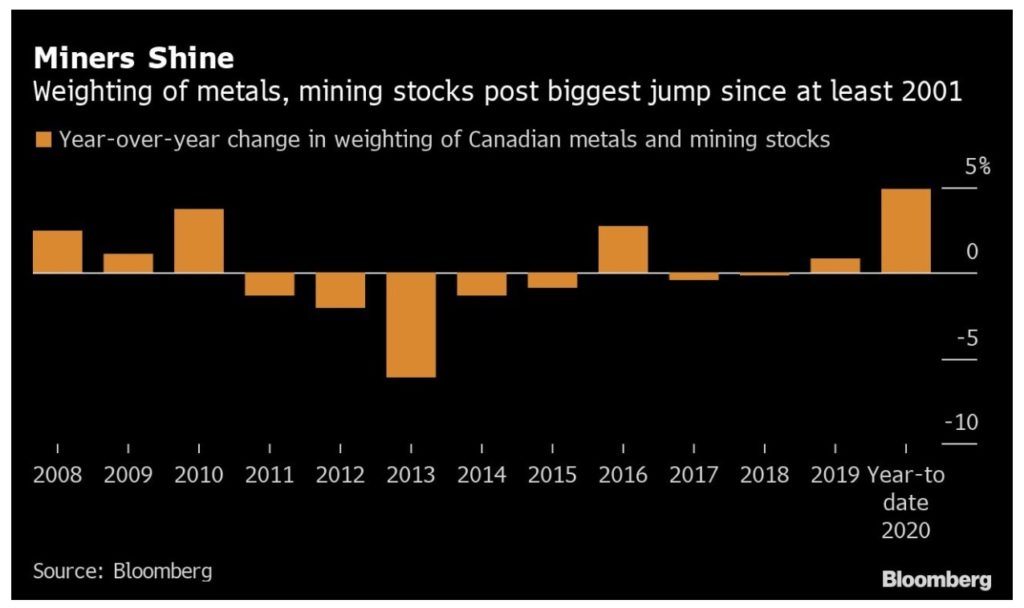

This pushes the weighting of metal and mining stocks on the index to the highest level since at least 2001 after an historically significant bump in the sector’s weighting occurring this year.

Also of note is that while Sprott Inc. is an asset management firm, their heavy focus on gold and silver investments also adds significant precious metal weight to the index.

Early week losses on the S&P/TSX Composite Index mostly recuperated but resistance ahead

The S&P/TSX Composite Index made progress towards recovering early week losses, with yesterday’s trading bringing it to within reaching distance of last week’s close. But with several tests of the 16190 level only just holding over the last week of trade, expect there to be some resistance here on the way back up before any eventual gains for the week should be expected.

—

(Featured image by Jason Hafso via Unsplash)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of CAStocks, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof.