As investors, it’s easy to believe that we’re living in a difficult time. Aside from stocks like Alimentation Couche-Tard (TSX: ATD-B) which have remained relatively stable, most of the market is looking like it could go either way at any moment.

What’s feeding the uncertainty that’s keeping investors awake at night

The current ambiguity that has come about is looking like it’s the result of the recent spike in COVID-19 cases that’s occurred almost simultaneously as reports stoke vaccine hopes. This is making stock picking a difficult subject to grapple with, even if, generally speaking, optimism is the word of the day.

Illustrating the point is the S&P/TSX Composite Index. Widely reported as rallying to its highest point since before COVID-19 broke out, it’s important to not overlook the relative lack of strength in the rally; any optimism is still being met by an almost equal dose of hesitation and what-ifs. Let us not forget that while the market is most definitely up (at 17313.10 pts.), it is only 2.84% above the previous post-COVID-outbreak high of 16,835.10 pts.

This previous high, which was attained back in August, was way back when we weren’t even sure if a vaccine would be discovered by the year’s end. That we (as an aggregate) are only 2-3% more optimistic now than we were then says something about the trepidation in the market now. Or it says something about how overvalued some stocks became during the health crisis.

But wait, there’s more

Adding to the potential uncertainty in the potentially over-valued base from which the current rally is taking place. While much of the market’s rally in the months since March have, understandably, been a correction for the dramatic dive that occurred as Coronavirus fears shredded all confidence to pieces, there’s more to it.

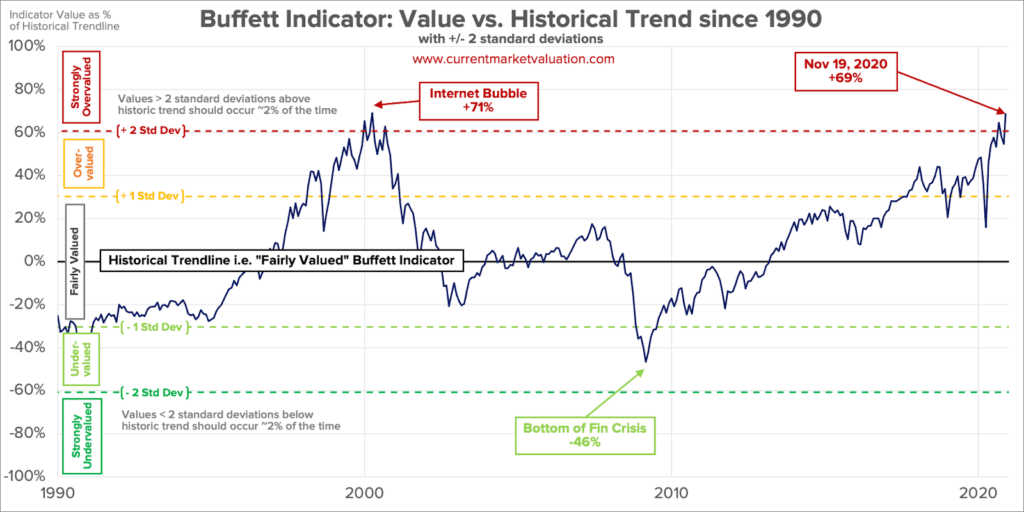

Primary amongst the catalysts for the post-outbreak rally are the huge injections of cash delivered by monetary and fiscal relief measures. Predictably, a lot of this money worked its way back into the stock market, providing massive liquidity that demonstrably outstrips underlying economic fundamentals. The popular Buffett Indicator, which measures market capitalization against GDP illustrates this nicely.

In times of uncertainty, look for stability in stocks like Alimentation Couche-Tard

If there’s one safe-haven in the market during all the turmoil of this year, it would have to be Alimentation Couch-Tard. Whilst Couche-Tard was certainly not spared from the initial tumble that just about everything experienced (even the venerable gold that we always turn to in times of uncertainty tumbled for a brief period), it quickly recovered back to its pre-COVID price levels and has remained there since.

And this is the kind of stability that investors worried about uncertainty should be looking for right now. With the resilience shown over the pandemic period, it is now almost a given that Couche-Tard will remain relatively stable no matter what COVID holds in store for us over the coming months.

But Alimentation Couche-Tard is more than stable; it’s undervalued in an overvalued market

While Alimentation Couche-Tard’s known for consumer convenience by all, in investing circles it’s also known for being utterly boring. Its slow and steady management team, that’s hesitant to do anything too drastic, just don’t do anything to make a real buzz.

This has led to it falling off the radar of many investors. Investors who are looking for more excitement—whether it be mergers and acquisitions, or future tech—end up focusing all of their attention on the Teslas and Shopifys of the world.

But Couch-Tard’s failure to get drawn into bidding wars (famously backing down from Marathon Petroleum’s sale of its Speedway gas stations, which went to 7-Eleven), and preferences for stable, long-term value over hype-generating announcements, makes it something of a sleeping dragon.

With a cool $3.5 billion in cash and cash-equivalents just sitting around burning a hole in Couche-Tards (very large) pockets, the company finds itself in a prime position to pounce on any future acquisition opportunities that crop up. Such an announcement would surely get the attention of more than a few investors that have otherwise been ignoring the company. And given the reputation of its management team, any such acquisition would be almost guaranteed to add significant value to Alimentation Couche-Tards business.

What are the risks of investing in Alimentation Couche-Tard?

The major risk that comes with investing in Couche-Tard is that it just keeps on doing what it has been doing so well throughout COVID-19: nothing. With a paltry forward dividend yield of just 0.65%, flat share prices could be seen as a huge opportunity cost if markets take off again.

But with the current uncertainty over the COVID-19 situation and the coming Christmas-season slowdown reducing liquidity, perhaps the potential lack of action is worth swallowing. The stability Couche-Tard offers, combined with its coiled-spring potential is a rare find in today’s turbulent markets.

—

(Featured Image by Patrick Le Barbenchon (CC BY-SA 3.0) via Wikimedia Commons)

DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of CAStocks, its management, staff or its associates. Please review our disclaimer for more information.

This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures.